We Believe In Protecting Generational Wealth, Because Family Legacy Matters

You Deserve Financial Protection For Your Hard-Earned Wealth!

Best Gold and Crypto IRA Companies for Wealth Preservation

Find the top precious metals and bitcoin IRAs to protect your retirement savings from recession, inflation, and a falling dollar.

“It's not how much money you make, but how much you keep!"

- Robert Kiyosaki

Protect Your Wealth by Investing in a Self-Directed Gold, Silver, or Crypto IRA

You've worked hard to save money for your retirement and your conventional IRA, SEP or 401(k) has been growing nicely. But now you’re really worried how rampant inflation and the looming recession is going to affect your nest egg.

How can you make sure your wealth is protected when the value of the dollar falls through the floor taking the stock market with it?

Many believe that the best way to preserve the value of your investments is to take advantage of alternative assets that often move in the opposite direction to traditional vehicles such as stocks and bonds.

But now there is a new class of asset to consider adding to your tax advantaged SDIRAs for wealth protection - cryptocurrencies such as Bitcoin and Ethereum. An increasing number of experts are calling these coins and tokens the digital versions of gold and silver as they have shown similar traits in how their prices move against the plummeting value of the dollar and an economic downturn.

If you're looking for a way to protect your wealth, investing in a self-directed gold, silver, or crypto IRA is the perfect solution.

Precious Metals IRA, Bitcoin IRA or Both?

Whether you are interested in investing in precious metals like gold and silver or the newer asset class of cryptocurrency, there are now plenty of alternative investment IRA companies to choose from.

It’s important to choose the best type of alternative individual retirement account for your own particular circumstances through talking to your financial advisor or tax professional, but we have done a lot of research to make it easier for you to find out what is available.

Gold IRAs for Traditional Wealth Preservation

This type of self-directed IRA allows you to invest directly in physical precious metals including gold, silver, platinum, and palladium. You can usually trade in several types of IRS approved bullion bars and coins inside your account, all with the same tax advantages as a conventional IRA.

Self-Directed IRAs for Crypto for Diversification and Growth Potential

A cryptocurrency IRA allows you to invest in

Combined Gold and Crypto IRAs for the Best of Both Worlds

You can now even combine certain types of physical metals with digital coins and tokens in one self-directed IRA. This gives you the potential to not only diversify and preserve the wealth of your portfolio with gold but also invest for growth through cryptocurrencies.

Whatever path you decide to take just click on the button that interests you most to go straight to the relevant category.

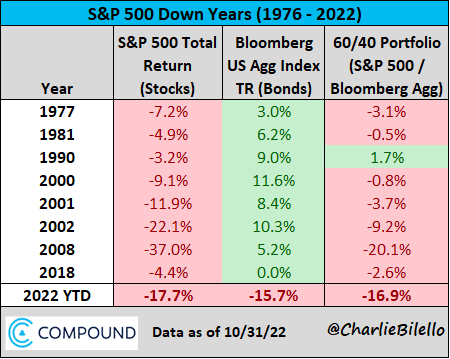

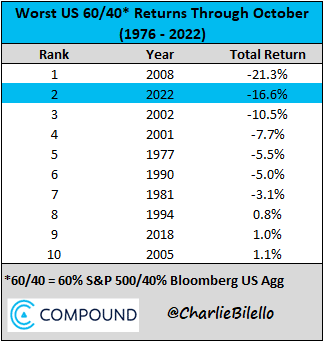

Traditional 60/40 Stock & Bond Portfolios are Outdated for Strong Asset Diversification and Wealth Savings

Silicon Valley Bank Collapses 2023: Gold and Silver's Investment Potential Explored

In March 2023, the unexpected collapse of Silicon Valley Bank sent shockwaves through the financial world. The bank's downfall came…

U.S.-China Relations: Navigating the Challenges for Global Stability

Tensions between the United States and China have been on the rise in recent years, and concerns are growing over…

Diesel Fuel Shortage: A Threat to the Global Economy

A diesel fuel shortage has set alarm bells for the global economy, with inventories dropping well below emergency levels. As…

7 Top-Rated Gold IRA Investment Companies 2023

By identifying the key areas important to you as a retirement investor in alternative assets, we have exhaustively researched many companies that provide precious metals IRAs. Our aim was to find the best firms who, in our opinion, deserve a place on our list of the 7 top-rated gold and silver investment companies.

As part of our process, we took into account genuine reviews across sites such as Trustlink as well as ratings from authority organizations including the Business Consumer Alliance (BCA) and the Better Business Bureau (BBB).

It is important that you always do your own due diligence and research of course to avoid precious metals IRA scams, but we believe our list will give you a great place to start!

Augusta Precious Metals Review – Best Overall Gold IRA Company

Disclaimer: Our website content does not constitute financial advice. Please speak to your financial advisor. We may receive compensation for referring the consumer to Augusta Precious Metals, Birch Gold Group, and other companies on this page.

Topping our list as the best overall gold IRA company when investing in precious metals for retirement is Augusta Precious Metals.

They are known for exceptional customer service and support, educating and guiding customers on all steps of their retirement investing journey. They have an excellent video blog on YouTube to help educate customers on why to invest in gold and why not to buy silver or gold.

With zero customer complaints on file at the BBB or the BCA it is easy to see why Augusta Precious Metals is our choice for the company with the best gold IRA customer service. Their dedicated team of experts in gold and silver investing look after clients for the lifetime of their investment, no matter how long they are with the company.

Augusta PM was recently rated in November 2022 by premier Money magazine as their recommended choice for 2022 best gold IRA company. One reason cited by the magazine that helps Augusta gold IRA company stand out, is "Augusta Precious Metals has a lot of customer education on its site. Ironically enough, one of the attributes that make this company rise to the top of our picks is its video-blog series of reasons why not to own gold." Augusta Precious Metals is very transparent and genuinely cares about people investing for the right reasons.

Investors looking for peace of mind in retirement with their savings can rest knowing Augusta PM has their best interest in mind.

Pros

- Nation's "Best Overall" of 2022 per Money magazine

- Exceptional customer service

- Caters to professionals and high-earners

- Educated and serious investors trust Augusta

- Harvard Economics grad on staff with vast financial experience

- Understands the investment needs of those 55-75

- Established in 2012

- Managed service to transfer or rollover funds

- Zero complaints recorded

- Best customer ratings across the board

- Free one-on-one webinars for investors

- BBB A+ and BCA AAA ratings

- Simple process to open a new account

- Low fees

- Vetted custodian and storage providers

Cons

- Very high minimum investment of $50,000

- Platinum and palladium not available

- Not ideal for brand new IRA investors with no IRA history

- Does not support storing IRA metals at customer's home

- English only. Does not have bilingual support staff

- Investors looking to do monthly purchases should look elsewhere

- Not ideal for retirees living off limited retirement savings

Unmatched Customer Service Rating

As you would expect from our pick for the best gold-IRA investment company, Augusta PM takes pride in customer service. The reviews across the board for Augusta are nearly all positive and the company prides itself on maintaining their spotless reputation. They even have an internal compliance team to ensure the company adheres to their strict ethical and legal guidelines.

No surprise then that their ratings on Trustlink are an impressive 4.9 out of 5 stars based on over 280 reviews.

Augusta Precious Metals Costs and Fees

Your customer success agent at APM will be able to provide the most up to date fees and special promotions they have running when you are ready to open an account. According to their website and other sources the only costs associated with an Augusta Precious Metals IRA we could find are as follows:

- IRA setup fee - $50

- No annual account fees

- Annual management fee - varies depending on your chosen custodian

- Annual storage fee - varies depending on your storage provider

For more information on Augusta gold IRA , check our full Augusta Precious Metals Review.

Goldco Review - Best for New Gold IRA Investors

A close second in our list of top-rated gold IRA companies, Goldco Precious Metals gets our vote for providing the best experience for new retirement investors in precious metals. With over 15 years' experience in providing gold and silver IRAs, the company has vast amounts of expert knowledge in getting the most out of gold investing for newcomers.

Goldco - At A Glance

Pros

- Exceptional customer service

- Founded in 2006

- Company of the Year winner 2021 - Stevie Awards

- BBB A+ rating and BCA Triple –A

- Managed service to rollover or transfer funds

- Highest buyback price guarantee

- Low flat fee structure

- Special offers often available

Cons

- High minimum investment of $25,000

- Platinum and palladium not available

Great Reputation and Customer Service

Founded on the principle of providing Americans with the education and means to protect their retirement savings from the ravages of inflation and market volatility, Goldco is widely acknowledged for its excellent customer service.

Customer reviews across the many independent review sites are strongly positive and the few complaints quickly resolved in most cases.

Reasonable Goldco Fees and Costs

Goldco do not publish their fee structure openly on their website, so you will need to contact a sales representative to get the latest information along with any special offers and promotions.

To give you an idea, here are the latest figures we have:

- No initial setup fees

- Annual IRA management - $80 flat fee

- Storage fees - depends on provider, typically between $100-$150 per year

- Custodian fees – varies by custodian, typically between $75-$200 per year

For more information, check out our full Goldco review.

Birch Gold Group Review – Longest Established Gold IRA Company

If longevity is something you’re looking for in a precious metals IRA company, Birch Gold Group, founded in 2003, is the longest-established of our top-rated providers. One of the most respected precious metals IRA firms in the industry, they use their experience to help educate and empower customers in making the right choices with their retirement investments. So, if you would like to open Gold IRAs or rollover your traditional IRA to a Silver IRA, BGG can help you along the way.

Birch Gold - At A Glance

Pros

- Founded in 2003

- Longest established company in the industry

- Low minimum initial investment of $10,000

- Great customer service reviews

- BBB A+ and BCA Triple-A ratings

- Focused on client education and communication

- Managed rollovers or transfers

- Vetted custodian and storage partners

- Wide range of gold and silver IRA-approved products

- Competitive buyback service

- Promotions often available

Cons

- Limited range of platinum or palladium products available

Top-Rated Customer Service

With such a long-established company, you expect to find a mixture of comments and ratings across the independent review sites, but with Birch Gold, this is not the case with a mostly positive review profile.

Any negative reviews or complaints are mainly concerned with confusion around market pricing and have mostly been resolved satisfactorily by the company reaching out the customer.

Birch Gold Group Costs and Fees

As with many alternative investment SDIRA firms, there is no clear pricing structure available on the Birch website so you will need to contact them to find out their current fees and promotions. Other online sources give a mixed view of the likely costs but here are some figures to give you an idea:

- One-time account setup fee - $50 Custodian admin fees - dependent on custodian but typically around $100 per year Storage fees - dependent on the chosen storage firm but usually around $100 per year

For more detailed information check out our full Birch Gold Group review.

Noble Gold Review – Best for Gold IRA Storage

A newcomer to the industry, Noble Gold was formed in 2016 and stood out for us as having great value precious metals segregated storage as part of their service. The company was founded by two friends with over 25 years of financial experience between them who wanted to improve transparency in the gold investment industry. It has quickly become established as a trusted precious metals IRA firm with many enthusiastic reviews.

Noble Gold - At A Glance

Pros

- Best value segregated gold IRA storage

- Low minimum IRA investment of $2,000

- Dedicated storage facility in Texas

- Growing number of positive reviews

- BCA Double-A rated and top BBB A+ rating

- Managed rollover or transfer of funds

- Special promotions often available

- Wide range of IRA eligible gold, silver, platinum and palladium products

- “No quibble” buyback program

- Simple flat fee structure

Cons

- Relatively new company in the industry formed in 2016

- High premium on some exclusive coins

Growing Reputation with Excellent Customer Service

As a newer company, there are not as many customer reviews as some more established firms, but Noble has already established a great reputation for itself. Trustlink is reporting a perfect 5-star rating across 123 reviews and the company has recently been awarded a Double-A rating on Business Consumer Alliance, just one below the highest grade.

There are just three complaints reported on BBB which have all been resolved.

Straightforward Noble Gold Fees

Unlike most other gold IRA companies, Noble lists the fees you can expect on their website as follows:

- No IRA account setup fee

- Annual account fee: $80 flat rate

- Segregated storage: $150 per year (Texas or Delaware)

- Custodian fee: Approximately $100 per year but depends on the custodian chosen

Read our more detailed Noble Gold review to find out more.

American Hartford – Best for a Low Minimum Investment

Next on our list of the 7 top-rated gold backed IRA companies is another relative industry newcomer, American Hartford Gold which we have picked out as having the lowest minimum investment to get started. In fact, there is no minimum at all making the family-owned and run company a great option to get started for smaller investors.

American Hartford Gold - At A Glance

Pros

- No minimum investment is required to open an SDIRA

- BCA Double-A and BBB A+ ratings

- Founded in 2015

- Great customer reviews

- Vetted custodian and storage partners

- Quick and easy account setup

- Simple rollover or transfer process

- Family owned and run

- Large selection of gold and silver products

- Buyback commitment with no fees

- Promotions often available

Cons

- Platinum can be included in IRA but no products available currently

- Palladium not included

Click the links below for:

American Hartford Gold website

FREE Gold & Silver Investment Guide from American Hartford Gold

Family Run Values and Customer Service

As a family-owned firm, Hartford Gold has a mission to educate clients about investing in precious metals and this shines through in the many positive customer reviews the company has obtained. Trustpilot has rated them at 4.9 stars out of 5 with over 1000 reviews posted, and excellent customer service is high on the list of comments.

We noted several complaints on BBB, mostly related to non-IRA purchases. American Hartford has always been quick to respond and resolve these issues.

American Hartford Gold Fees

Hartford do not publish any sort of fee schedule so you will need to contact them for the latest prices and promotions. Recently we have found typical costs to be:

- Account setup fee - $50 one-time

- No annual fees from AHG

- Custodian fees - starting at $225 per year (Equity Trust is their custodian partner)

- Storage fees – depends on storage type and provider, typically $100-$150 per year

Advantage Gold - At A Glance

Pros

- Top rated customer service

- Online learning center

- Established in 2014

- Claim to be the leader in precious metal IRA rollovers

- Vetted partners for custodial and storage services

- Top ratings from BBB (A+) and BCA (AAA)

- Wide selection of IRA approved gold, silver, platinum, and palladium coins

- Buyback commitment

Cons

- Higher premium for some exclusive coins

Industry Leading Customer Service

Advantage claim on their website to be the industry leader in rolling over self-directed individual retirement accounts backed by precious metals. Their online review profile reflects this claim with many positive customer comments about the firm's services. Trustlink has rated them at 4.9 stars out of 5 based on almost 500 reviews.

Only one complaint has currently been lodged on BBB which has been resolved.

Advantage Gold IRA Fees

The firm does not publish any fee structure on their website but do state that they have two custodians as recommended choices, Equity Trust and STRATA Trust. Our research indicates that you can expect the following fees from these custodial providers:

- Account setup - $50 one-time

- Annual account fee – $100 flat fee or $225 upwards

- Annual storage fee - $100-$150 depending on type of storage

Regal Assets Review - Best For Investing Options

UPDATE November 2022: We've read recent complaints on Trustpilot that caused us to pause our recommendation on Regal Assets until further favorable details come out before lifting this hold. Our recommendations for all other companies on this page remain as trustworthy options to consider.

Making our list for best investing choices gold IRA company is Regal Assets. Founded in 2009, the company specializes in helping investors successfully diversify their retirement accounts and investment portfolios by investing in gold, silver, platinum, palladium and more recently, cryptocurrencies.

Regal Assets - At A Glance

Pros

- Well-known alternative assets IRA company

- Low $10,000 gold IRA initial minimum investment

- Flat rate fee structure (waived for the first year)

- In business since 2009

- BCA Double-A and ⦁ BBB A+ ratings

- Straightforward rollover or transfer-managed service

- Hold both precious metals and crypto in your IRA

- No fees on precious metal buyback

- Segregated secure storage included

- Only sells IRA-eligible gold, silver, etc. bullion, and coins

Cons

- Not BBB accredited

First-Rate Customer Service and Ratings

The company is well known for their exceptional customer service, ease of account opening and a straightforward rollover process. This is reflected in their great reputation with an overwhelming number of positive reviews across independent review sites such as Trustlink (4.6 out of 5 from over 1000 reviews). In comparison there are very few negative comments or complaints to be found, although of course we did find some.

No Regal Assets Fees for the First Year

Regal Assets does not charge a setup fee when initially opening the individual retirement account and have a flat standard annual fee for both administration, custodianship, and storage. These fees are at the lower end for the industry and are also waived for the first year.

As a guide, here is the latest pricing structure we have as of January 2022:

- Annual admin and custodianship fee (waived for first year) - $100

- Annual segregated storage fee (also waived for the first year) - $150

- No initial setup fees

- No fees for rollovers/transfers

- Precious metal buyback - no fees

See our in-depth Regal Assets review for more information.

5 Top Rated Crypto IRA Companies 2023

The world of investing in crypto is still relatively young and offers many opportunities for you as a retirement investor to diversify your savings through the new vehicle of crypto backed IRAs.

We developed a comprehensive review process that looks at all the important aspects of companies that offer this type of self-directed IRA to find what we consider to be the top 5 digital currency backed IRA providers.

Researching what a company has to offer and checking independent authority sites like TrustPilot and Consumer Affairs helped us to identify our shortlist and we think you will find it a great place to start.

We recommend you always do your own research before investing with any company.

Bitcoin IRA Review– Best Overall Crypto IRA Company

The pioneer of crypto IRAs as an alternative investment for retirement, Bitcoin IRA is our selection for the best overall cryptocurrency self-directed IRA provider. Founded in 2015, the company has its own 24/7 trading platform that allows customers to self-trade any time of the day or night and great customer service.

Bitcoin IRA - At A Glance

Pros

- First cryptocurrency IRA platform

- 60+ cryptocurrencies supported

- Minimum investment of $3,000 to get started

- Proprietary 24/7 self-trading platform

- Multi-factor authentication for security

- BBB A+ rating

- Google rating of 4.6 stars from over 700 reviews

- BitGo digital wallet

- 100% offline cold storage at BitGo Trust

- Up to $700M in custody insurance through BitGo

- Simple IRA rollover or transfer process

- Available as a 401(k), Roth IRA, or traditional IRA

- Invest in both gold and crypto in the same IRA

Cons

- Higher fees than some other providers

Not Just Bitcoin Supported

Despite their name, Bitcoin IRA is not only for Bitcoin, but currently supports 60+ other crypto products as well including Ethereum (ETH), Ripple (XRP) and Litecoin (LTC).

High Bitcoin IRA Fees

Many negative comments online are relating to the fees the firm charges which are quite high in comparison to some competitors:

- Set-up fee – 5.99% of incoming funds

- 00% trading fee on buys and sells

- Monthly admin fee of 0.08% with a minimum of $20

These can vary according to the size of account so speak to a customer representative to check what may currently be available.

Check out our full Bitcoin IRA review for more information and insights.

iTrustCapital Review – Best for Lower IRA Fees

Second on our list of our top 5 rated crypto IRA companies is iTrustCapital, which we believe has some of the lowest fees for setting up and operating your account. Founded in 2019 by leaders in the alternative investment IRA industry, the company already has some excellent reviews across Google and Trustpilot.

iTrustCapital - At A Glance

Pros

- Very low fees compared to competitors

- Only requires a minimum of $1,000 to open an account

- Trade in crypto, gold and silver through your IRA

- $320 million insurance through Coinbase Custody

- Trade in real time on a 24/7 self-trading platform

- 25+ cryptocurrencies supported

- BBB A rating

- Trustpilot rating of 4.4 stars out of 5 over 2,200+ reviews

- Leading security provided by Coinbase Custody and Fireblocks

- Online learning portal

- Simple guided rollover or transfer process

- Available as a traditional, SEP or Roth IRA

Cons

- Not BBB accredited

Crypto Coins and Tokens Supported

A self-directed individual retirement account through iTrustCapital supports over 25 different types of coins including Steller (XLM), Ethereum (ETH), Uniswap (UNI), Bitcoin (BTC) and Solana (SOL).

Enjoy Lower Fees from iTrustCapital

Unlike some other alternative IRA providers, the company is very open with its competitive fee structure:

- $0 monthly account fee

- 1% crypto transaction fee

- Gold transactions - $50 over spot per ounce

- Silver transactions - $2.50 over spot per ounce

Check out our full iTrustCapital review for more information and insights.

Coin IRA – Best for Customer Support

Another top-rated crypto IRA company is Coin IRA and we have given them our vote as the best for customer service and support. Founded in 2017, their mission is to deliver excellence, exceed customer expectations and build a lasting relationship based on trust which in our experience, they excel on.

Coin IRA - At A Glance

Pros

- No maintenance or setup fees

- Expert crypto IRA consultants on hand 8am-5pm weekdays

- $5,000 minimum investment for opening an account

- Industry leading security

- Live web chat staffed by knowledgeable and helpful agents

- BBB A+ accredited business

- 100% offline storage with no fees

- Multi-factor authorization for account access

- 24/7 online trading platform

- $100 million custody insurance

- Low transaction fees

- Open an account in 5 minutes

- Managed rollover or transfer of funds

- Traditional, Roth or SEP IRA available

Cons

- Not as many different cryptos as some competitors

IRS-Approved Cryptocurrencies Available

Coin IRA offers around 18 coins and tokens that are approved by the IRS to hold in an alternative investment backed IRA including Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BTC), Ethereum Classic (ETC), and Litecoin (LTC).

No Account Fees at Coin IRA

According to their website, the company has some of the lowest fees in the industry for opening and operating an account with them:

- No setup fees

- No storage fees

- No account maintenance fees

- Transaction fees – 1.25% on buys, 1% on sells

You can find more detailed information in our comprehensive Coin IRA review.

BitIRA – Best for Security

Next on our list of cryptocurrency IRA companies is BitIRA, which claims to be the most secure digital currency IRA in the world. They back this up with end-to-end insurance, cold storage in grade-5 nuclear bunkers and multi-factor, multi-encrypted authentication! The firm also has the top ratings on both the BBB and the BCA sites.

BitIRA - At A Glance

Pros

- World-class 5-layer security features

- 100% cold offline storage

- Multi-factor authentication

- $100 million end-to-end insurance

- Online account dashboard available 24/7

- 18+ cryptocurrencies supported

- BBB A+ and ⦁ BCA Triple-A ratings

- Consumer Affairs authorized partner

- Guided rollover or transfer process

- Reasonable $5,000 minimum investment

- Available as traditional, Roth, SEP or SIMPLE IRAs

- Dedicated digital currency IRA specialists on hand

- Exclusive partnership with Genesis trading platform

Cons

- Depending on the custodian chosen fees could be higher than average

- No transaction fees published on their website

Major Cryptocurrencies Supported

Many of the major digital coins and tokens are available in a BitIRA alternative investment account including Bitcoin (BTC), Bitcoin Cash (BCH), Chainlink (LINK), Ethereum (ETH), Ethereum Classic (ETC) and Litecoin (LTC).

No Monthly BitIRA Account Fees

The company has recently stopped charging a monthly account fee but there may still be costs charged by the custodian. BitIRA currently only works with Equity Trust or Preferred Trust who both have their own fee structure which you can find by contacting them directly.

BitIRA do not openly publish their trading fees which is a concern as we believe all digital IRA providers should have these clearly displayed on their website.

Click here for our full BitIRA review for more details and insights.

Regal Assets – Best for Large Investors

UPDATE November 2022: We are placing our recommendation on hold for Regal Assets until further notice. Please see our reason above for RA under our Gold IRA reviews.

Of course, we’ve featured Regal Assets above in our review of top gold IRA companies, but you can also invest in crypto with their flagship Regal IRA product. We recently spoke to Regal and their minimum investment for crypto is now $200,000 making them our best company for large investors.

Regal Assets Crypto IRA - At A Glance

Pros

- Highly rated gold and crypto IRA company

- One of the first companies in the US to be authorized to manage crypto IRAs

- Quick and simple account setup

- Simple flat rate account fees (waived for first year)

- Founded in 2009

- BBB A+ and BCA AA ratings

- Guided transfer or rollover service

- Hold both crypto precious metals and crypto in your IRA

- Offline cold secure storage and insurance included

- Easy going sales approach

- Over 20 coins and tokens available

Cons

- Trading fees not disclosed on website

- Not BBB accredited

- $200,000 required to open a cryptocurrency IRA

Most Major Crypto Coins and Tokens Available

Regal has focused on some of the most popular crypto products for investors to choose as part of their alternative individual investment account including Bitcoin (BTC), Ethereum (ETH) and Dogecoin (DOGE).

Flat Rate Account Fees Waived for 12 Months

The latest account fees payable after the first year we have recorded are as follows:

- Admin and custodianship fee - $100 per year

- Cold storage fee - $150 per year

- No initial setup fees

There are no trading fees quoted on their website which we think should be remedied, so you will need to call the company to find out what they are currently.

Alto CryptoIRA – Best for New Investors

Our final company on our list of top crypto IRA providers is Alto and their CryptoIRA product. This firm was launched in 2018 so is relatively new but have some great reviews on Trustpilot (4.4 out of 5 stars over nearly 1000 reviews) and focus very much on supporting customers. They also have a $10 minimum investment to open a new account so are great if you only have a small retirement plan to transfer into your SDIRA.

Alto CryptoIRA - At A Glance

Pros

- $320 million commercial crime coverage through Coinbase

- Hot and cold offline storage provided by Coinbase

- Over 200 coins and tokens available

- Coinbase custody services

- Traditional, Roth and SEP IRAs available

- Incredibly low $10 investment minimum

- No setup or monthly fees

- 1% trade fee

- Integrated 24/7 real time Coinbase trading platform

- Free concierge service to help setup and fund your account

Cons

- Not rated on BBB or BCA

Wide Range of Crypto IRA Coins and Tokens

Through their integration with Coinbase, Alto are able to offer probably one of the largest selections of digital currencies for any crypto IRA on the market. These include all the top products including Bitcoin (BTH), Ethereum (ETH), Solana (SOL) and Dogecoin (DOGE).

Some of the Lowest Bitcoin IRA Fees in the Industry

Refreshingly, Alto make their IRA fees readily available on their website. Currently these are:

- Account fee - $0

- Custody fee - $0

- Trade fee – 1%

Only $10 minimum investment required to open an account!

You can find more detailed information in our extensive Alto CryptoIRA review.

Top Self-Directed IRAs for Both Gold and Crypto 2023

There are currently very few companies that offer an alternative investment IRA where you can hold both some type of precious metals as well as cryptocurrencies, but we believe we have identified the top-rated companies in this innovative industry.

All these companies also feature in the separate gold and crypto categories above and so we used the same exhaustive review process to rate them for the combined category here.

We believe these providers offer a great opportunity to combine the benefits of both types of assets to help preserve and even grow your retirement wealth even it times of inflation and recession.

It’s important to make sure you talk to all the companies we’ve listed and to do your own research before investing.

Regal Assets – Best Overall for a Combined Gold and Crypto IRA

UPDATE November 2022: We are placing our Gold IRA and Crypto IRA company recommendation on hold for RA until further notice. Please see our reason above for RA under our Gold IRA reviews.

Regal Assets launched their Regal IRA product in 2018 and claims to be the first alternative assets IRA to combine the investment power of both precious metals and digital assets into one retirement account.

The Regal IRA is the only alternative assets self-directed IRA that we know of where you can invest in gold, silver, platinum, and palladium as well as the major cryptocurrencies.

It’s also the only one where you can invest in both bullion bars and coins as well which is why we have given them our vote as the best overall company for this type of account.

See our separate review sections above on Regal for a full list of features in each category.

Bitcoin Self Directed IRA – Best for Fast Gold and Crypto Investing

Bitcoin IRA added gold alongside crypto as an available asset to their 24/7 trading platform in 2020, but as you’re just buying the digital ownership rights to certified gold bars the transactions are instant. We were so impressed with this system we awarded the company our ‘best for fast gold and crypto trading’ title.

Bitcoin IRA already has the gold bars underpinning this system in storage with Brinks bullion vaults, so you get all the benefits of owning physical gold but without any supply and delivery issues. It is also cheaper to trade and own with no expensive brokerage or storage fees to pay.

See the section above for Bitcoin IRA in the crypto category for full details on fees etc.

iTrustCapital – Best for Innovative Gold, Silver and Crypto IRA Solution

Just after Bitcoin IRA launched their gold offering in 2020, iTrustCapital announced they had added not only gold but also silver as digital assets you could trade on their platform alongside crypto. Their system is cutting edge technology and so we had no hesitation in giving them our award for the most innovative combined gold, silver and crypto IRA solution.

The iTrustCapital system allows clients to place orders for digital ownership rights at any time of the day or night with trades being actioned by a Kitco, a specialist dealer. Ownership is tracked digitally through a blockchain ledger on the VaultChain platform. The actual gold and silver backing the system is stored at the Royal Canadian Mint secure storage facility.

You can find more information on iTrustCapital in the cryptocurrency IRA category above.

Best Custodians for Precious Metals and Crypto SDIRAs

Custodians are required by the IRS to oversee all individual retirement accounts and can be a financial institution, or an IRS approved non-bank entity. Their function is to ensure your retirement savings are responsibly managed, looking after things such as buying and selling assets, keeping track of transactions and tax reporting etc.

We have mentioned some custodians in amongst the different reviews above, but here is a list of some of the most popular ones for reference:

- Equity Trust

- Preferred Trust

- New Direction IRA

- Kingdom Trust

- Gold Star Trust Company

- STRATA Trust

- Millennium Trust Company

- BitGo (digital assets only)

- Pacific Premier Trust (Formerly Pensco Trust Company)

- Advanta IRA Company

You can find more detailed information on the above custodians in our select reviews listed below:

Equity Trust Company custodian review

Frequently Asked Questions about Gold and Bitcoin IRAs

What is a Gold IRA?

A gold IRA is a self-directed retirement account that allows you to invest in gold, silver, and other precious metals. This type of account is perfect for investors who want more freedom and flexibility when it comes to their retirement savings.

Types of gold IRA include traditional IRAs which are funded by pre-tax dollars where you only get taxed on disbursements and Roth IRAs which you use post-tax dollars to fund but enjoy tax free withdrawals in retirement.

Can I Put Crypto in a Roth IRA?

Yes! You can put crypto in a self-directed Roth

Cryptocurrency IRA providers supply their own list of coins and tokens you can trade in, but most will include the more popular currencies by market cap such as Ethereum (ETH), Bitcoin Cash (BTC), Bitcoin (BTC), Ethereum Classic (ETC), and Litecoin (LTC).

What is a Gold IRA Rollover?

A gold IRA rollover involves taking funds from your conventional IRA, 401(k) or other eligible retirement account and transferring the funds into your new precious metals back IRA.

This is one of the most popular methods of funding a new account as you can lock in any gains you may have already made on your investments without incurring any tax penalties in most cases when following the IRA rollover tax guidelines from the IRS.

What is IRA Eligible Gold and Silver?

The IRS has set guidelines for what it deems IRA-eligible gold, silver, platinum, and palladium. It’s important to make sure that any investments you make in your gold IRA follow these rules. All of our top-rated silver companies will provide guidance to make sure you are only buying the correct bars and coins.

For reference, the purity and finesse of any metals you purchase must be at least:

- Gold | .9950

- Silver | .9990

- Platinum | .9995

- Palladium | .9995

Risk Disclosure: Any investments, including crypto assets and precious metals, such as gold, silver, platinum, and palladium, come with an inherent risk, where you could end up making less money than what you put in. Before investing your hard-earned cash, be sure to speak with a licensed professional financial advisor first. Always remember that past performance is not an indication of future returns.

Disclaimer: This website's owners may be compensated for suggesting certain businesses, goods, and services. While we do everything possible to verify that all of our content is accurate, the information we provide may not be impartial or unbiased, and it does not constitute financial advice.

Featured Articles

Silicon Valley Bank Collapses 2023: Gold and Silver's Investment Potential Explored

In March 2023, the unexpected collapse of Silicon Valley Bank sent shockwaves through the financial world. The bank's downfall came…

Fidelity Gold IRA Vs. Augusta Precious Metals Gold IRA Company 2023 Comparison

When it comes to choosing the right gold IRA company for your needs, proper comparisons are important. Different gold IRA…

Bitcoin Vs. Silver: Which Is A Better Investment For Wealth Creation and Protection?

Investing is a big part of getting a retirement fund, but the currency you choose matters. While many people picture…

Is Gold a Good Investment for Retirement?

We are seeing more people invest their retirement portfolio in precious metals. With an increasing amount of the population investing…

Is Silver a Good Investment for Retirement? The Retirement Secret Big Banks Don’t Want You to Know!

You could be overwhelmed with choices when it comes to selecting an investment strategy that will help you save for…

U.S.-China Relations: Navigating the Challenges for Global Stability

Tensions between the United States and China have been on the rise in recent years, and concerns are growing over…

Sign up to receive your free report now!

"*" indicates required fields

Reasons Why You Should Invest In Gold, Silver, Palladium, Platinum, Bitcoin and Digital Currencies

Sign up to receive your free gold report now!

"*" indicates required fields