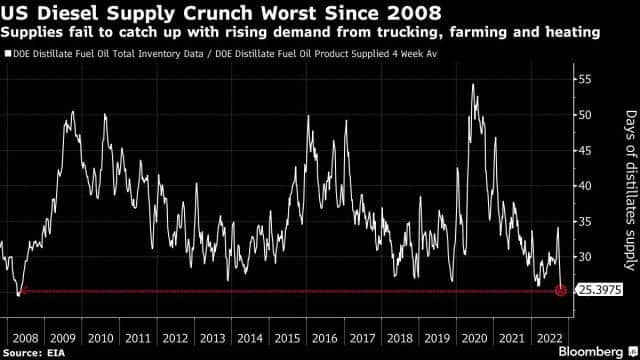

A diesel fuel shortage has set alarm bells for the global economy, with inventories dropping well below emergency levels.

As per recent data, it is estimated that the US has only 25 days of diesel left in its reserves- a scary amount that has become a threat to the global economy. This rolling total is at a critical point with refiners having difficulty meeting the demand, which impacts the supply.

Let's look at some of the key points to understand the diesel shortage 2022 situation better:

- In the US, the reserves of diesel have reached the lowest point ever that hasn't been seen since 2008.

- Diesel prices have reached $5.333 per gallon, which is a 33% increase compared to the last year and are expected to go even higher.

- The Northeast's diesel supply, the Mississippi River's dryness, and a probable rail strike are all contributing to increasing fuel demand, prompting calls for federal government intervention to enhance supply.

This shows that the diesel fuel shortage situation is getting worse day by day. But why is this happening? Let's look at the reasons behind such a dreadful situation:

Why is There a Diesel Shortage?

Even though the refiners slowed the supply after the pandemic hit, the truck operators kept on buying diesel at high levels so that their deliveries didn't stop. Here are some of the other reasons for the shortage of diesel fuel:

Shutdowns Due to the Pandemic

Did you know since 2020, the US refineries' capacity has shrunk by 1 million barrels per day?

Crude oil is already in relatively short supply. But when it comes to converting that raw material into fuels like diesel and gasoline, the bottleneck is considerably more severe. This happened because of a pandemic when the refineries were forced to close their least profitable plants due to less demand for diesel.

Russia's War on Ukraine

Shipping disruptions and worker strikes in Europe have also reduced refinery output. With the European Union's impending shift away from the Russian supply, things could get much more dramatic. Europe relies on diesel more than any other region on the planet. Over 500 million barrels are delivered by ship each year, with roughly half of that typically loaded at Russian ports. The United States has also suspended shipments from Russia, which was a major supplier to the East Coast last winter.

NOW is the time to Protect your investments!

Claim Your FREE Report!

Backwardation

Backwardation is a market structure that occurs when premiums for supplies with fast deliveries are higher than premiums for longer-term suppliers. Not only was the dispersion extraordinarily wide, but the backwardation was exceptionally protracted. Because of this market structure, suppliers are incentivized to sell now rather than hang onto the product to create stocks.

Now you must be wondering if the planet will have no diesel in the future. Well, that's not exactly true. Let's have a look at it in detail:

Are We Really Running Out of Diesel?

Even though the US has left with 25 days of diesel, it doesn't mean that we are running out of diesel.

While the inventories of diesel are lower than they have historically been, the supply shortage is no cause for panic. Refineries are doing everything they can to increase the supply of diesel.

In the meantime, diesel fuel prices will be high until the market forces cause demand to slow. In this way, the refineries have the time they need to build up the supply.

Impact of the Diesel Fuel Shortage

Diesel plays an essential role when it comes to the global economy. It is the only source to power trucks, buses, ships, or trains. On top of that, it drives machinery for construction, farming, and manufacturing. With the high prices of natural gas, Diesel is even used to generate power!

So, we can say that the world depends largely on diesel. The shortage of diesel has a great impact on the following:

Global Economy

The diesel fuel shortage can boost inflation and undercut economic growth. It is also estimated by Rice University's Baker Institute of Public Policy that the rising price of diesel in the United States alone would cost the economy $100 billion.

Inventories are expected to reach the lowest and then decline much worse by March, just after sanctions go into effect and cut the region off from Russian seaborne supply. Northwest Europe is also facing a low buffer. Poorer nations like Pakistan are being shut out of the global export market because suppliers are unable to reserve enough cargo to satisfy the country's domestic needs.

Soon there's a possibility that every region on the planet will face some sort of diesel shortage, resulting in worsened inflation and economic growth.

Overall Effects on Construction and Transportation

As the majority of our goods are delivered using diesel fuel, any company in this industry faces the risk of low diesel supply, which could drive up prices.

As many power trucks and excavators run on diesel, the additional cost of delivering raw materials will drive up home construction expenses at a time when customers are already dealing with rising loan rates. This would also have an influence on the mortgage business since consumers would be hesitant to borrow money, making things more expensive.

Simply put, the diesel shortage has a huge impact on goods transportation, resulting in high prices for other industries too. This would hurt customers' confidence as the threat of recession is on its way!

<<Learn More about Having Peace of Mind with a Gold IRA>>

What’s Next for Diesel Fuel Prices?

As we all know, the demand for diesel will only rise, so actions must be taken promptly to overcome the diesel shortage situation. To aid with supplies and pricing, the Biden Administration has considered banning petroleum exports. President Biden recently declared that 15 million barrels of oil would be released from the strategic reserve in December to enhance supply. However, there is no clear indication that this will fix or significantly help us with our diesel shortfall.

It is vital to highlight that this fuel is utilized for heating and trucking, which are both necessary to keep the economy running, especially during the winter. Diesel fuels commerce and freight because freight trains, ships, excavators, and trucks require it.

If refineries do not raise capacity or do not discover means to refill supplies, diesel scarcity might pose numerous issues. If diesel fuel prices continue to rise, customers will feel the impact as the price of everything rises.

For those living in the North East and New England area of the U.S., where diesel aka heating oil is vital to keep homes warm during the cold winter months, a shortage of heating oil and high prices, could lead to an emergency condition for the safety and well-being of many.

Protect Your Retirement from Skyrocketing Inflation with a Gold and Precious Metals IRA

It should be obvious by now how much the world is affected by the diesel fuel shortage, with the rising prices of goods, construction, and so on!

There's a possibility that prices will go even higher due to the shortage. Many experts think that if fuel prices continue to climb, skyrocketing inflation will invariably worsen. Although crude oil has received a lot of attention, diesel issues could be just as bad, if not worse.

Physical gold may be the most effective hedge against inflation. It is an excellent commodity, and the best way to profit from it is by owning it directly. Gold is known as a solid investment that has been proven, time and time again to survive inflation, has no counterparty risk, and can safeguard your assets from a wide range of adverse economic conditions.

Claim Your FREE Report to Find Out Why NOW is

the Best Time to Buy Gold

With inflation rising at an alarming rate, the dollar in a virtual freefall, and economic factors pointing toward recession, there has never been a better time to secure your wealth with a Gold or Precious Metals IRA.

Click here to learn how diversifying your retirement assets can help.

Risk Disclosure: All investments including precious metals, such as gold and silver, involve risk and you may get less back than what you put in. Always consult a licensed professional financial advisor before investing your money. Consumers should be aware that past performance does not guarantee future returns.

Disclaimer: The website's owners of Cryptowealthbay.com may be compensated for recommending certain companies, products, and services. While we endeavor to make sure all our content is accurate, the information we provide may not be neutral or independent and does not constitute financial advice.