Goldco’s long history of high ethical standards and exceptional customer service makes them the Go-To Precious Metals Company for investors of all ages.

Invest in Silver and Gold with Confidence: Why Goldco is the Top Choice

Founded in 2006, Goldco precious metals is a privately owned company in Calabasas, California, that specializes in asset protection and wealth management. They are a top precious metals IRA company due to their reputation for providing excellent customer service and commitment, to offering a wide range of investment options for their clients. The company is dedicated to helping individuals invest in physical silver and other precious metals, such as gold and platinum and palladium, to secure their retirement savings.

One of the key benefits of investing with Goldco is their focus on transparency. The company is fully transparent about the process of acquiring and storing precious metals, so clients know exactly what they are investing in. The company also provides educational resources, such as guides and videos, to help clients understand the value and benefits of investing in precious metals.

Another reason that Goldco is a top precious metals IRA company is its commitment to security. The company uses secure storage facilities, such as Brinks and Delaware Depository, to protect clients’ investments. The facilities are fully insured, so clients can have peace of mind knowing that their investments are safe and secure.

In addition, Goldco offers a wide range of investment options, so clients can choose the option that best meets their investment goals and risk tolerance. The company offers a variety of IRA account types, such as traditional, Roth, and SEP IRA, and clients can choose to invest in individual precious metal coins, bars, or rounds.

Goldco provides excellent customer service. The company has a team of experienced investment professionals who are available to answer any questions that clients may have. The team is knowledgeable and dedicated to helping clients make informed investment decisions, so they can feel confident in their investment choices.

Overall, Goldco is a top precious metals IRA company due to its reputation for providing excellent customer service, its commitment to transparency, its focus on security, its wide range of investment options, and its knowledgeable and dedicated investment professionals.

Why Trust Goldco?

- Rated A+ by the BBB

- AAA Rating From the BCA

- 2500+ 5 Star Ratings

- Stevie Awards 2022 Company of the Year

- Recognized by INC 5000 – 6 Years in a Row

How a Precious Metals IRA Works

A Precious Metals IRA, or Self-Directed Individual Retirement Account SDIRA, is a type of retirement account that allows individuals to hold physical precious metals, such as silver, gold, platinum, and palladium, within the account. These metals are held in the form of coins or bars and stored in a depository for safekeeping.

To set up a Precious Metals IRA, an individual must first open a traditional or Roth IRA with a custodian that specializes in precious metals. The custodian will then work with the individual to purchase the precious metals and arrange for storage. The metals must meet certain standards set by the IRS, such as being at least 99.5% pure.

One of the benefits of a Precious Metals IRA is the potential for diversification of the individual's retirement portfolio. Precious metals have a low correlation with other asset classes, such as stocks and bonds, which means that they can provide a hedge against inflation and market volatility. Additionally, precious metals have a history of retaining their value over time, which can provide a level of stability for the individual's retirement savings.

Another benefit is that precious metals IRA's can be a good way to protect your savings from inflation and market downturns. The value of metals, particularly gold and silver, tends to go up when the economy is struggling, providing a buffer against economic downturns. It's important to weigh the potential benefits and drawbacks to decide if a Precious Metals IRA is the right choice for you.

A Macroeconomic Perspective on Silver and Gold IRA Investing

Macroeconomic factors such as GDP, inflation, and unemployment play a crucial role in determining the prices of silver and gold and the opportunities for investing in a Silver or Gold IRA. Investing in a Precious Metals IRA is a popular way to diversify one's portfolio and protect against market volatility. These investments are often considered safe-haven assets and their prices are affected by a variety of factors including macroeconomic conditions.

Economic Growth or GDP

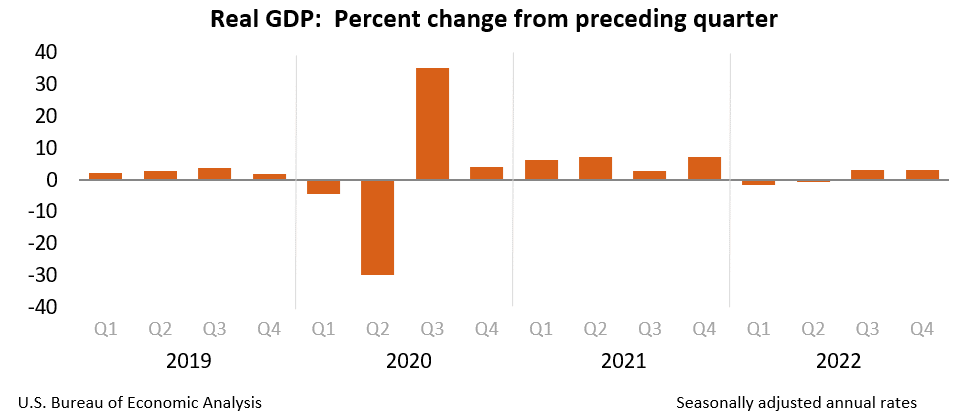

The first factor is the GDP or Gross Domestic Product. A country's GDP is the value of all goods and services produced by that country for a specific time period, usually one year. It is used to measure the size and growth of an economy and is considered one of the most important indicators of a country's economic health. When GDP is growing, it is an indication of a strong economy, and investors tend to focus on assets that offer higher returns such as stocks. On the other hand, when GDP is in decline, it is an indication of a weak economy, and investors tend to shift their focus to safe-haven assets like silver and gold.

Unemployment

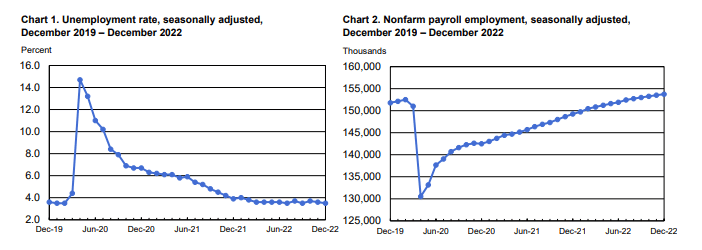

The second factor is unemployment. Unemployment measures the number of people who are looking for work but are unable to find it. High unemployment rates can indicate weak economic conditions, while low unemployment rates can indicate strong economic conditions. It is one of the most closely watched indicators of the health of the economy. As a result, when unemployment is high, investors tend to invest in safe-haven assets such as gold and silver, which can lead to an increase in demand and a rise in prices.

Inflation

The third factor is inflation. Inflation is the rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. Central Banks use monetary policy to target a specific inflation rate, usually 2% annually. Inflation can affect gold and silver prices because they are often seen as a hedge against inflation and currency devaluation. When inflation is high, the value of currency decreases, making gold and silver more attractive to investors. As a result, gold and silver prices tend to rise during periods of high inflation.

Deflation

Deflation, or a persistent decline in prices, has been a growing concern among investors, causing them to seek safe-haven investments to protect their wealth. While both silver and gold have traditionally been popular choices for this purpose, recent trends suggest that more investors are turning to silver over gold. The reason for this shift is because silver, being an industrial metal, may hold its value better in times of deflation as demand for it may increase due to lower prices and a pick-up in economic activity. On the other hand, gold's value is largely determined by supply and demand dynamics in the jewelry and investment markets, which may not be as resilient in deflationary environments. As a result, more investors are choosing silver over gold as a hedge against deflation, believing it to be a more reliable investment in uncertain times.

Disinflation

Despite the concerns of disinflation, silver and gold IRAs remain popular among investors for several reasons. Mainly, precious metals have a low correlation with other traditional investments, making them a good diversification tool for portfolios. Also, silver and gold have intrinsic value, making them a hedge against inflation, deflation, and other economic uncertainties. Silver and gold IRAs offer a tangible asset that can be held in physical form, giving investors peace of mind in a volatile market.

However, silver, being an industrial metal, may hold its value better than gold in a disinflationary environment due to its wider range of applications. As a result, silver and gold IRA investors may need to reassess their investment strategy and consider rebalancing their portfolios in light of disinflationary concerns. It is important for investors to stay informed about economic trends and adjust their investments accordingly to ensure the long-term preservation of their wealth.

Stagflation

Stagflation is a rare economic condition where an economy experiences both inflation and stagnation simultaneously. This presents challenges for traditional investments such as stocks and bonds, which may underperform in this environment. As a result, many investors seek alternative options to preserve their wealth, and silver and gold IRAs are often seen as a safe haven. These precious metals tend to hold their value in times of economic uncertainty and provide a hedge against inflation and deflation. Again, silver and gold IRAs offer a tangible asset that can be used as money or for trade, giving investors peace of mind. Investing in precious metal IRAs can help protect assets from economic uncertainty and provide a low correlation with other traditional investments, making them a good diversification tool for portfolios.

The Coming Recession – Protect Your Wealth with Silver IRAs

The signs of a coming recession are all around us – declining GDP, high unemployment, and a slowdown in consumer spending. In times of economic uncertainty, it's natural to want to protect your hard-earned wealth, and a Silver Individual Retirement Account (IRA) can be an excellent option for doing just that.

A Silver IRA is a type of retirement account that allows you to invest in physical silver, rather than paper investments like stocks or bonds. This provides a valuable source of diversification for your retirement portfolio, helping to mitigate the risk of any one investment losing value during a recession.

One of the main reasons that silver is such a good investment during a recession is its scarcity. Unlike paper money, the supply of silver is limited and cannot be artificially increased. This makes it a valuable and stable store of wealth that can weather economic uncertainty. In addition, silver has a wide range of industrial uses, including electronics and solar panels, which can provide a steady demand for the metal, even during difficult economic times.

Another reason to consider a Silver IRA during a recession is the potential for silver prices to increase during periods of economic uncertainty. As central banks implement monetary policy measures to stimulate the economy, such as lowering interest rates or printing more money, the value of paper money can decline. This can lead to inflation and a decline in the purchasing power of your savings, making it more difficult to maintain your standard of living in retirement. By contrast, the value of silver can increase during these times, providing a valuable hedge against inflation and a decline in the value of paper money.

When choosing a Silver IRA, it's important to work with a reputable and experienced company, and custodian, that specializes in precious metal investments. Your custodian will be responsible for storing and safeguarding your silver, as well as providing guidance on the most appropriate investments for your needs.

In addition to choosing the right company, it's also important to consider the type of silver you want to invest in. You can choose from a variety of options, including coins, bars, and rounds, each with their own advantages and disadvantages. Your account representative can provide guidance on the most appropriate type of silver for your investment goals and risk tolerance.

It's worth considering the potential tax benefits of a Silver IRA. With a traditional IRA, you can defer taxes on your investment earnings until you withdraw the funds in retirement. With a Roth IRA, you can withdraw your investment earnings tax-free in retirement. This can provide valuable tax savings and help to maximize the potential of your investment over the long term.

Physical silver, in a Goldco Silver IRA can be an excellent option for protecting your wealth during a coming recession. With its scarcity, wide range of industrial uses, and potential for growth during periods of economic uncertainty, silver can provide a valuable source of diversification for your retirement portfolio. By choosing the right precious metals company, selecting the appropriate type of silver, and considering the potential tax benefits, you can help ensure that your investment is well-positioned for the long term.

The Implications of Putin's Gold-for-Oil Trade on the Global Economy

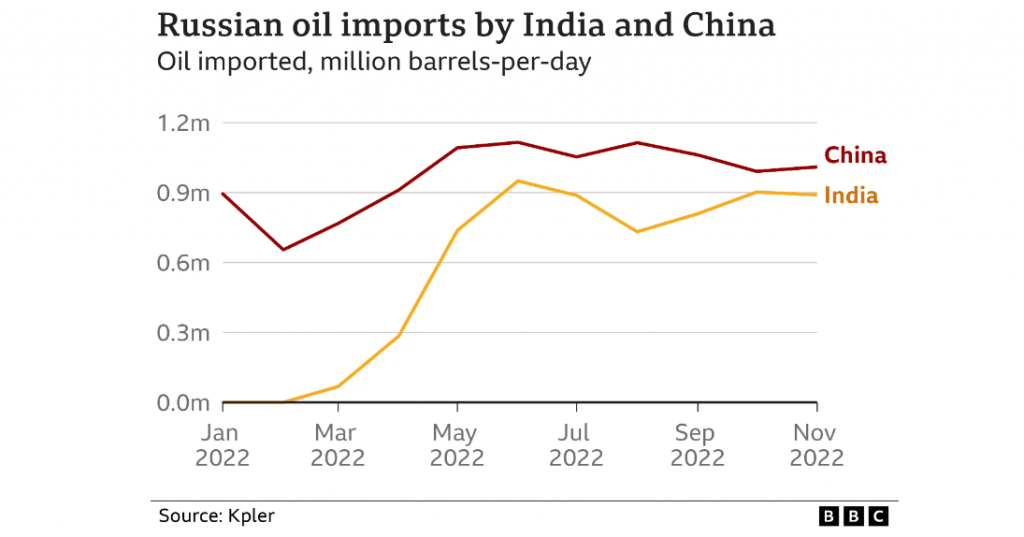

In recent years, Russia has been increasingly turning to gold as a way to bypass Western-imposed economic sanctions and maintain its access to international markets. One aspect of this strategy is the use of gold-for-oil trade deals, in which Russia agrees to sell oil to other countries in exchange for gold. These deals have significant implications for the global economy, both in terms of the impact on Russia's economy and the broader implications for the role of gold and oil in international trade.

One of the main reasons for Russia's shift towards gold-for-oil trade is to bypass the sanctions imposed on the country by the West. These sanctions, which were put in place in response to Russia's actions in Ukraine and annexation of Crimea, have had a significant impact on the Russian economy. They have made it difficult for Russian companies to access international markets and have limited Russia's ability to borrow money from international banks. By turning to gold as a form of payment for oil, Russia is able to circumvent these sanctions and maintain access to international markets.

The use of gold-for-oil trade also has implications for the role of gold and oil in the global economy. Historically, the US dollar has been the dominant currency in international trade, particularly in the oil market. However, as countries like Russia and China look to reduce their dependence on the US dollar and the global financial system dominated by the US, they are turning to alternative forms of payment. Gold has long been seen as a safe haven asset and a hedge against currency fluctuations and inflation, making it an attractive alternative to the US dollar.

In addition, gold-for-oil trade deals also have implications for the oil market. As more countries turn to gold as a form of payment for oil, it could lead to a shift in the balance of power in the global oil market. Currently, OPEC (Organization of the Petroleum Exporting Countries) and a few non-OPEC countries such as Russia, control a large portion of the world's oil reserves and production, and therefore have significant influence on oil prices.

However, as more countries turn to gold-for-oil trade, it could lead to a decentralization of the global oil market, a reduction in the influence of these major oil-producing countries, and a major upswing in the price of gold.

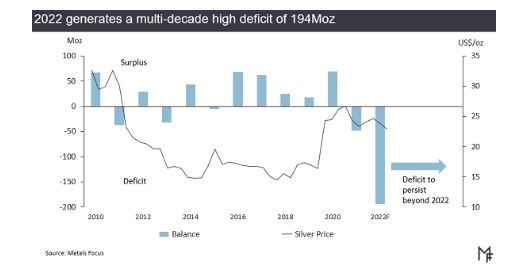

Could Silver Be Bigger Than Gold in 2023?

As we look ahead to 2023, one question on the minds of many investors is whether silver precious metals could potentially be bigger than gold. While gold has long been considered the “king of precious metals,” silver has been gaining traction in recent years as an attractive investment opportunity. Here, we'll take a closer look at the factors that may contribute to silver's growth in the coming years and what it could mean for investors.

First, it's important to understand that silver and gold are both considered precious metals, but they have some key differences. Gold is a safe haven asset and is considered a store of value, while silver is more of an industrial metal. This means that silver is used in a variety of industrial applications, such as electronics, solar panels, and medical equipment, which can drive demand for the metal.

One of the biggest factors that could contribute to silver's growth in 2023 is the increasing demand for sustainable energy. With climate change and environmental concerns on the rise, there is a growing push for renewable energy sources, such as solar and wind power. Silver is a key component in the production of solar panels, and as the demand for renewable energy increases, so too will the demand for silver.

Another factor that could boost silver's growth in 2023 is the rising demand for electric vehicles (EVs). Silver is used in the production of EV batteries, and as the popularity of EVs continues to grow, so too will the demand for silver. Additionally, the increasing adoption of 5G technology, which also uses silver, is also expected to drive the demand for the metal.

In addition to these factors, silver's status as a safe haven asset could also contribute to its growth in 2023. While gold is traditionally considered the safe haven asset of choice, silver has been gaining ground in recent years as investors look for diversification in their portfolios. Silver's lower price point compared to gold makes it more accessible for investors with smaller budgets, which could attract more investors to the market.

It's also worth noting that silver's growth in 2023 could be driven by a combination of factors, including a weaker US dollar, rising inflation, and geopolitical tensions. These factors can contribute to increased demand for precious metals as a store of value and hedge against market volatility.

While it's impossible to predict with certainty whether silver will be bigger than gold in 2023, the factors outlined above suggest that silver has the potential to see significant growth in the coming years. Investors who are interested in adding precious metals to their portfolios may want to consider, at the very least, including silver alongside gold as a way to diversify their holdings and potentially capitalize on silver's growth potential.

Why Goldco is the Choice for…

The Goldco IRA Process

1.) Open an IRA

It's as easy as completing an agreement and securing your purchase. Your personally assigned representative will guide you through each step.

2.) Fund Your Self-Directed IRA

Your account can be funded by transferring assets from your existing TSP, 403(b), 401(k), IRA or savings accounts, usually with no tax consequences.

3.) Purchase Your Precious Metals

Once your Precious Metals IRA has been established and funded, you will be able to select the precious metals you wish to hold.

Pros and Cons of Investing with Goldco

Pros

Cons

- $25,000 Minimum Deposit

Goldco’s Minimum Requirements and Fees

Minimum Purchase Requirement – $25.000

IRA Setup Fee (one time) – $50*

Wire Transfer Fee (one time) – $30*

Maintenance Fees (annual) – $80*

Storage Fees (annual) – $150* segregated/$100* non-segregated

* Ask about current promotions as fees may be reimbursed

Is Goldco the Right Choice for You?

Goldco is a precious metals investment company that offers a range of services including IRA rollovers, purchasing physical precious metals, and secure storage solutions. They specialize in helping clients invest in silver and gold for retirement purposes. Whether you are new to precious metals investing or an experienced investor, Goldco has a team of specialists available to assist you with your investment needs. They have over 10,000 favorable customer reviews, a strong reputation in the industry and an A+ rating from the Better Business Bureau. If you are looking for a reliable and knowledgeable company to help with your precious metals investments, Goldco may be the right choice for you.

Frequently Asked Questions

What is Goldco?

Goldco is a precious metals investment company that specializes in helping clients purchase and store physical gold and silver for retirement purposes.

What services does Goldco offer?

Goldco offers a range of services, including IRA rollovers, purchasing physical precious metals, and secure storage solutions.

What is a Gold or Silver IRA?

It's a type of individual retirement account that holds physical precious metals like silver and gold instead of traditional investments like stocks or bonds.

Are there any tax benefits with a Silver or Gold IRA?

Yes, contributions to a traditional IRA may be tax-deductible and the investment gains in the account grow tax-deferred until withdrawal.

Is Goldco a reliable company?

Goldco has a strong reputation in the precious metals industry, with over a decade of experience and an A+ rating from the Better Business Bureau.

Can I hold both gold and silver in the same IRA account?

Yes, it is possible to hold a mix of precious metals in the same IRA.

How do I know if my silver & gold are eligible for a Precious Metals IRA?

The IRS has specific guidelines for precious metals that are eligible to be held in an IRA, such as specific fineness and purity standards. Please reference IRC Section 408(m)(3)(A) from the IRS for more details.

Can I invest in other precious metals besides gold and silver through Goldco?

Yes, Goldco offers a range of precious metal options including platinum and palladium.

Does Goldco offer assistance with setting up a Gold or Silver IRA?

Yes, Goldco has a team of specialists that can help clients establish and manage a Silver or Gold IRA. They will assist with the process of transferring funds from a traditional IRA or 401(k) into a precious metals IRA.

Can I take physical possession of my metals held in a Silver / Gold IRA!

Typically, no. The precious metals are stored in a third-party depository for safekeeping, but you can sell or withdraw them through the custodian.

Diversify Your Retirement Investments with Hard Assets

If you're like the majority of Americans who are tired of increasingly high living expenses, including the astronomical rise in energy prices, you're undoubtedly concerned about your future. With a failing economy, excessive inflation, the possibility of major stock market disaster, and the anticipated further decline in the value of the dollar, there has never been a better time to consider a Precious Metals IRA than there is right now. Click here to find out more about how a Silver or Gold IRA may be right for you.

Risk Disclosure: All investments including precious metals, such as gold and silver, involve risk and you may get less back than what you put in. Always consult a licensed professional financial advisor before investing your money. Consumers should be aware that past performance does not guarantee future returns.

Disclaimer: The owners of this website may be compensated for recommending certain companies, products, and services. While we endeavor to make sure all our content is accurate, the information we provide may not be neutral or independent and does not constitute financial advice.