An Introduction to Millennium Trust Company

The Millennium Trust Company is a Chicago-based group that works as a custodian service for IRA accounts and trusts. They are an IRS-approved custodian to handle services, like self-directed IRAs, to facilitate transactions, be compliant and ensure annual tax forms are processed, such as 5498s and 1099s.

Millennium has been serving people since 2000 and has more than 300,000 accounts in its custodial support. These accounts are worth a total of nearly $11 billion.

Millennium is an IRA and trust administrative company that handles the paperwork and legal points for your funds. The group can help you by forming your IRA or trust and maintaining it as necessary. They also provide account services within the health space, such as Employer-sponsored Health Saving Account HSA), Health Care Flexible Spending Accounts (FSAs), and Health Reimbursement Arrangements (HRAs).

The group works as an intermediary between you and the bank or trust company that holds your actual deposits. The work is about ensuring your funds are managed right and that you receive the best tax benefits and advantages.

The Millennium Trust Company has more than 200 professionals on hand to help you with your trust needs. The trusted expertise of the group can help you see what investment solutions are available for your use, whether it entails traditional trust funds or alternative options. You can select whatever services interest you the most.

What Trusts Does Millennium Offer?

The first part of this Millennium Trust Company review to check involves how the group can help you with various trusts. The Millennium Trust Company supports various types of trusts.

- Estate Trusts – An estate trust will help manage estate taxes while ensuring your assets go to the proper beneficiaries at the appropriate time.

- Charitable Trusts – Your charitable trust can help you control charitable contributions while reducing your estate and income tax liabilities.

- Business Trusts – A business trust will delegate the authority to allow someone to access a beneficiary stake as necessary.

What About IRAs?

If you need assistance with administering an IRA, you can also get in touch with the Millennium Trust Company. The specialists at Millennium can help you with a basic, SEP, Roth, or regular IRA. The team's expertise in administering a range of IRAs has contributed to Millennium's status as a top provider of financial services.

With Millennium's assistance, you can investigate investment portfolios and execute transactions for stocks, mutual funds, and ETFs using the specialized trade center. You can learn how to manage transactions and complete an investment successfully with the aid of the Millennium platform.

Is Millennium a Self-Directed IRA Custodian?

Millennium offers self-directed IRAs that let you choose what assets you can support. You can stick with traditional assets, or you can go for alternative assets that interest you more. The Millennium Trust Company employees can help you see if whatever assets you want to include are eligible for your IRA. They have experience in a wide range of alt asset investments for retirement accounts, and handling evolving needs of individual investors.

Can You Get Precious Metals Support?

The Millennium Trust Company also offers precious metals IRA custodian services for a variety of gold and silver IRA specialized companies. Meaning you can invest in gold, silver, and other metals within your retirement account.

Millennium works with Gold Bullion International to help buy, sell, and store various metal coins and bars. The group also provides insurance for all investments, ensuring your safety and protection when dealing with these assets.

What Are the Benefits of Using Millennium?

There are many advantages that come with hiring Millennium Trust Company for your trust or IRA needs:

- Millennium offers a research platform that can help you find different investments to include in your trust or IRA.

- Millennium will provide the latest details on how well your IRA or trust is working. You can learn from Millennium about how to reduce your tax burden while tracking your investments.

- The group also provides a transparent fee schedule, ensuring you aren’t caught off guard by certain expenses.

- Millennium supports automatic rollover programs for when you’re trying to move funds from one account to another.

- There are separate custody solutions available for whatever investments interest you the most. These include custody options for precious metals and traditional stocks.

What Fees Are Involved?

There are a few fees to note when looking at what Millennium can do for your funds:

- Establishment fee – $50

- Annual fee – $100

- Custody fee – Varies by investment, but it is paid annually; the fee can be worth hundreds of dollars if you have alternative assets to maintain

- Asset orders – $15 to $50 to facilitate each order

- Processing fees – $25 to $250, with the total varying over the complexity of the transaction

How Should You Choose the Right Trust?

It can be daunting to figure out which trust is right for your needs. You’ll need to think about the type of trust you want to use, how much money you want to invest in your trust, and how long that trust will last.

You can use a few points to help you figure out which trust is ideal for your investment needs:

- Look at who you are going to give your funds to when the trust expires. Make sure you choose something where your assets will go in the right places.

- Figure out what items you are going to include in your trust. Not all items in a trust are eligible for tax benefits.

- Check on any taxes you might spend on your funds in a trust before sticking with something. Your funds might not be taxed depending on how long they are in your account, although the rules may vary by state.

- Review your state’s tax laws for how trusts work. Look at what can be exempt from taxes and whatever rules might be present when getting something to work.

How Do You Set Up a Trust With Millennium?

You can ensure financial stability when getting a trust ready through Millennium, but you must complete the required paperwork to make it work. You can use a few steps to get your trust with Millennium ready:

- Determine what assets you will include in your trust.

- Identify the beneficiaries of your trust.

- Prepare the rules for your trust, including when you will release its assets and what conditions are necessary.

- List Millennium as your designated trustee. As a trustee, Millennium will review all the legal aspects of your trust account while checking on tax benefits and advantages that might be available.

The workers at Millennium are available to help with your trust setup as necessary. You can contact the team online or by phone for help.

What Are People Saying About Millennium?

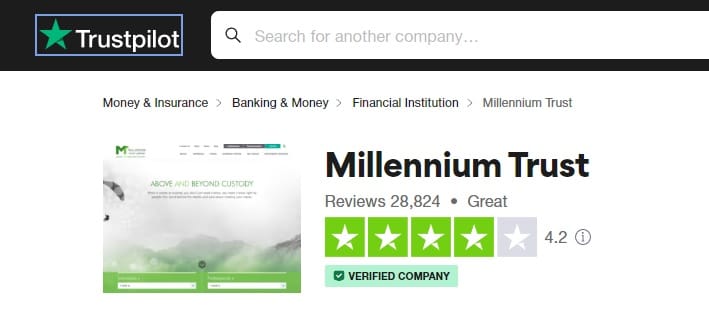

The Millennium Trust Company is accredited by the Better Business Bureau. The group obtained its accreditation in 2017 and has an A+ rating. According to Trustpilot reviews as of January 2023, they have a 4.2 star rating. On Birdeye and Yelp, their have been conflicting reviews. The group has also been very effective in managing various complaints.

How Has the Group Leveraged Technology?

The Millennium Trust Company offers a variety of technology options to help you identify what investments are accessible as the investment industry is always expanding. The Millennium Alternative Investment Network, run by Millennium, compiles information on the most recent alternative investments and how to participate in them.

The organization also provides a knowledge center and tax center with the most recent details on the laws governing trusts. Additionally, you can examine valuations and make trades as necessary using the group's digital platform. The system makes it easy for consumers to manage their money without adding unnecessary complexity.

Customer Support

You can use the customer support services at Millennium in many ways:

- The group has dedicated phone lines for self-directed accounts and automatic rollover accounts.

- The live chat feature on the Millennium website lets you communicate with someone who can help you with your retirement accounts or funds.

- The knowledge center and tax center on the Millennium website also provide updated info on how to manage your funds, including how to handle tax-related situations.

How to Make More Out of Your Trust

You can get more from your trust when you have an idea of how you’re going to use your funds and manage your savings. Here are a few things you can do to improve how well you manage your trust:

- Look at what considerations you want to follow in your trust. You can make some irrevocable steps in your trust that cannot be reversed. You can get transfer tax benefits from these irrevocable points because you are transferring those assets out of your estate.

- Create suitable rules for how your funds will be used. You may establish limits where someone can only use funds for a college education, for example. These rules help ensure your funds are only going towards responsible things that also offer tax benefits.

- Asset protection provisions can appear in your trust. Provisions can include limits on what investments can be utilized in your trust, preventing people from investing in things that might be too risky.

- There should be goals in your trust surrounding how you’re going to get your funds ready for use. Be clear in getting those goals ready if you want to succeed in managing your money.

Summary

The Millennium Trust Company can help you manage your retirement funds through a trust or IRA. A trust will ensure your funds receive the tax benefits you deserve while protecting how your money will work in the future. Millennium provides many trusts for everyone’s needs, including business and charitable trusts.

The people at Millennium can help you set up investment accounts and check how well your funds are working. You can get assistance in seeing how well the team can manage your funds, as well as other custody services.

Is It Better Than Equity?

One question people have about the Millennium Trust Company involves whether it is a better option than the Equity Trust Company. Equity does provide various IRA and trust custodial services, including help in managing alternative assets.

Both groups provide thorough customer support and assistance from hundreds of experienced and respectful employees. They can also help you manage your funds well while being transparent about fees. For our complete review on Equity Trust to help with your due diligence and compare further, click here.

Be sure to compare these two options when looking for something that works for you.

Conclusion

It is essential that you have a trustee on hand who can help you make important decisions on how your funds will work. The Millennium Trust Company will support your estate and tax planning needs by assisting you with a trust or IRA. The team will provide help in seeing how your funds are working and establishing the right tax benefits. You can also get support in trading different assets as necessary.

You can consider the Millennium Trust Company when finding a team to help you with your assets. The experts here will help you find a plan that works for you.

Risk Disclosure: Any investments into alternative assets, including cryptocurrencies and precious metals, such as gold, silver, platinum, and palladium, come with an inherent risk, where you could end up making less money than what you put in. Before investing your hard-earned cash, be sure to speak with licensed professional financial advisor first. Always remember that past performance is not an indication of future returns.

Disclaimer: The website's owners of Cryptowealthbay.com may be compensated for suggesting certain businesses, goods, and services. While we do everything possible to verify that all of our content is accurate, the information we provide may not be impartial or unbiased, and it does not constitute financial advice.